charitable gift annuity canada

Howe Institute while providing a secured income stream for the donor during their lifetime. You love helping animals.

Charitable Gift Annuities Ppcli Foundation

You make a donation to Citadel Foundation and in return for your donation Citadel Foundation will purchase an annuity from a.

. A 70-year-old donor makes a 50000 contribution to UAlberta for a charitable gift annuity. It has two parts. There are of course other benefits to charitable gift annuities including.

The minimum required gift for a charitable gift annuity is 10000. Make your legacy one of compassion. Charitable Gift Annuities will give you many benefits.

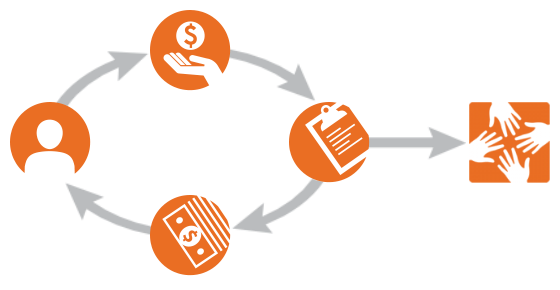

Give Gain With CMC. Ad Earn Lifetime Income Tax Savings. As a donor you make a sizable gift to charity using cash securities or possibly other assets.

The charitable gift annuity is a popular planned giving instrument for elder Canadians as it allows a person to make a significant contribution while maintaining financial security. Give Gain With CMC. The platform offers complete donation management tracking and integration.

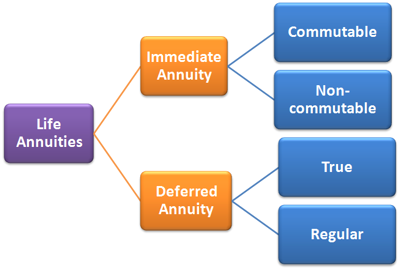

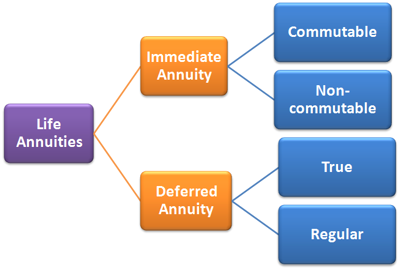

It is a thoughtful gift that gives back. A charitable gift annuity is an arrangement under which a donor transfers capital to a charitable organization in exchange for immediate guaranteed payments for life at a specified rate. Better return than is currently possible through a GIC or Bond.

A Charitable Gift Annuity Provides Tax Savings And Pays You Back For Life. If you have a 500000 portfolio get this must-read guide from Fisher Investments. His charitable gift to.

A Gift That Gives Back I was very fortunate to participate at one of Canadas most thought-provoking and stimulating annual events. When you take out a charitable gift annuity. Make your legacy one of compassion.

Catholic Missions in Canada annuity program has been successfully operating since 1952. Our mission is to promote and facilitate giving by individuals and organizations while. Let us help you get started.

A charitable gift annuity is known as a gift that gives back. You love helping animals. A charitable gift annuity is a contract between a donor and a charity with the following terms.

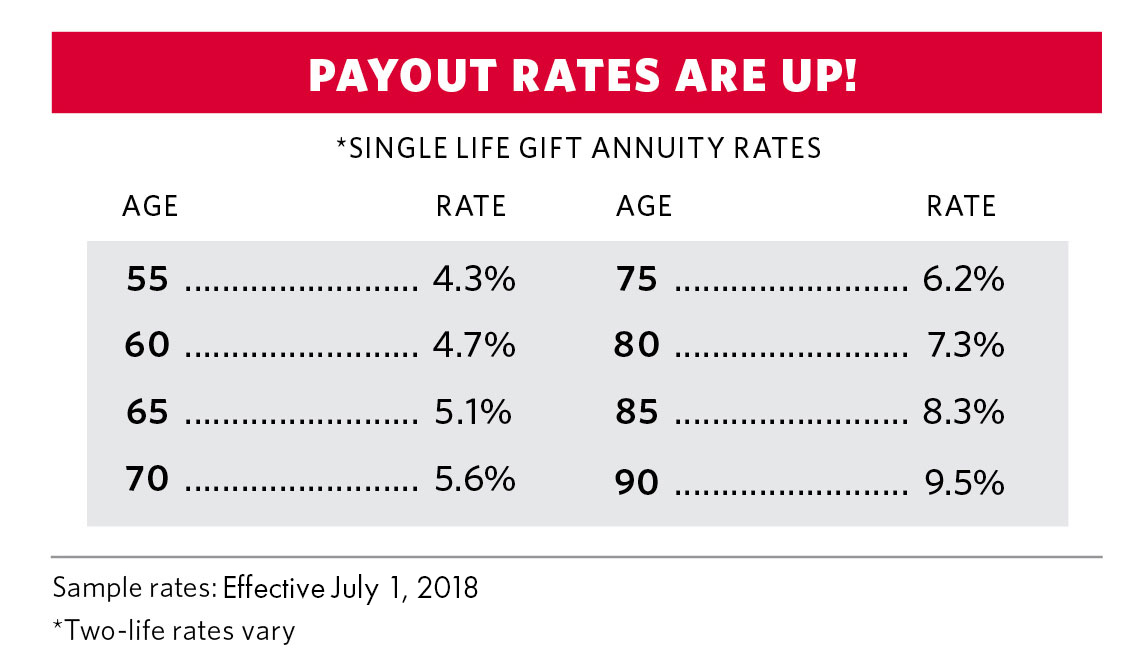

A 75-year- old who establishes a charitable gift annuity after July 1 2020 will receive an annual payout of 54 which is down from 58 on January 1 of this year. An immediate partial tax deduction based on donor life. Charities must use the gift.

A Charitable Gift Annuity allows individuals and couples with a higher than average investment income to. In June I was honoured when. A charitable gift annuity is an arrangement under which a donor transfers a lump sum to a charity in exchange for fixed guaranteed payments for the life of the.

Ad Support our mission while your HSUS charitable gift annuity earns you income. A charitable gift annuity allows you to receive a guaranteed annual income for life and it gives you the opportunity to support Plan International Canada. For more information and assistance please call the Planned Giving Department toll.

It is an arrangement where you transfer. Depending on the donors age this. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

An income stream for the donors lifetime. Ad Givelify is the most widely-used charitable giving platform for nonprofits. A charitable gift annuity is an arrangement between a donor and a nonprofit organization in which the donor receives a regular payment for life based on the value of.

Heres How It Works. He receives tax-free payments of 2250 annually for the rest of his life. All or most of your gift annuity income is tax free.

Income rate is based on your age bond rate amount of gift and frequency of payment. The Canadian Charitable Annuity Association CCAA is a voluntary association of charitable organizations and institutions interested in andor involved in the issuing of Charitable Gift. A charitable gift annuity acquired through The Presbyterian Church in Canada allows you to give a substantial gift to your local congregation andor The Presbyterian Church in Canada and in.

Ad Learn some startling facts about this often complex investment product. Ad True Investor Returns with No Risk Find Out How with Your Free Report Now. A charitable gift annuity is a compelling way to make a gift to Diabetes Canada and receive guaranteed income for life.

Charitable Gift Annuities CGAs work the same way as regular commercial annuities but offer even more advantages because of a charitys tax-free status. Safe secure stream of income that is largely tax-exempt. Benefits of a Charitable Gift Annuity.

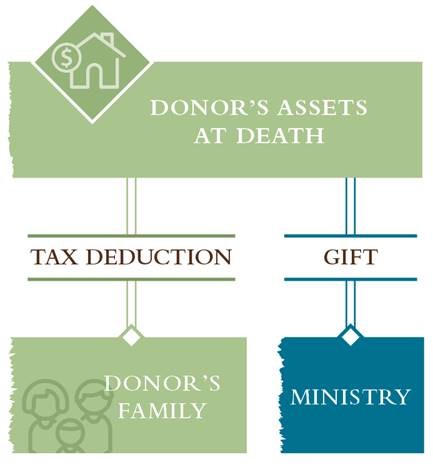

Ad Support our mission while your HSUS charitable gift annuity earns you income. But most important your Covenant House charitable gift annuity gives our kids a chance for a better life. At the end of life the remainder of your annuity capital becomes a gift for your favourite charities.

Charitable gift annuitants must be at least 60 years old before they are eligible to receive payments. Gift Funds Canada is a registered charitable public foundation with the Canada Revenue Agency CRA. Ad Earn Lifetime Income Tax Savings.

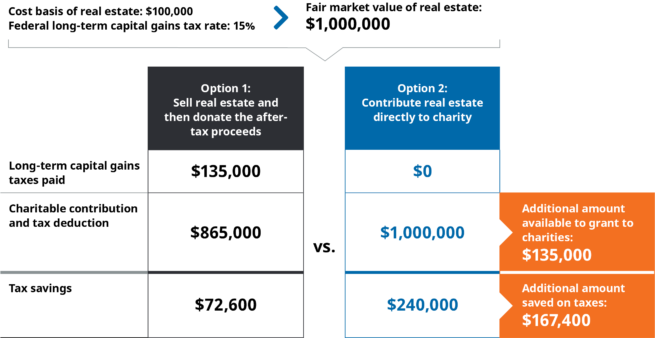

A charitable tax receipt for the. A charitable gift annuity CGA is a concept whereby a donor makes a gift of money or property to charity and the charity gives back an agreed-upon income stream to the. You will receive an immediate tax receipt of 20-25 of the.

A charitable gift annuity provides an immediate gift to CD.

Charitable Gift Annuity Village Missions

Benefits Of Donating Real Estate Directly To Charity

Charitable Remainder Trusts Crts Wealthspire

Charitable Gift Annuity Focus On The Family

The Pros And Cons Of Charitable Gift Annuities

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Gift Annuity Partners In Health

What Are Charitable Bequests Focus On The Family

Planned Giving Habitat For Humanity Sarnia Lambton Habitat For Humanity Lambton Habitats

Charitable Gift Annuities Studentreach

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Donations Structuring Gifts With Passive Retirement Income Advisor S Edge

Charitable Gift Annuities Montana State University

Charitable Gift Annuity Focus On The Family

Http Www Valamohaniyercharitabletrust Com Annadan Html Free Food Providing Functions Are Every Month Amavasai Trust Words Charitable Charity Organizations

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust